Was GE’s New CFO a Risky Choice?

from CFO.com - January 10, 2020

Carolina Dybeck Happe's background makes her an unusual choice to run finance at the struggling conglomerate, a research report suggests.

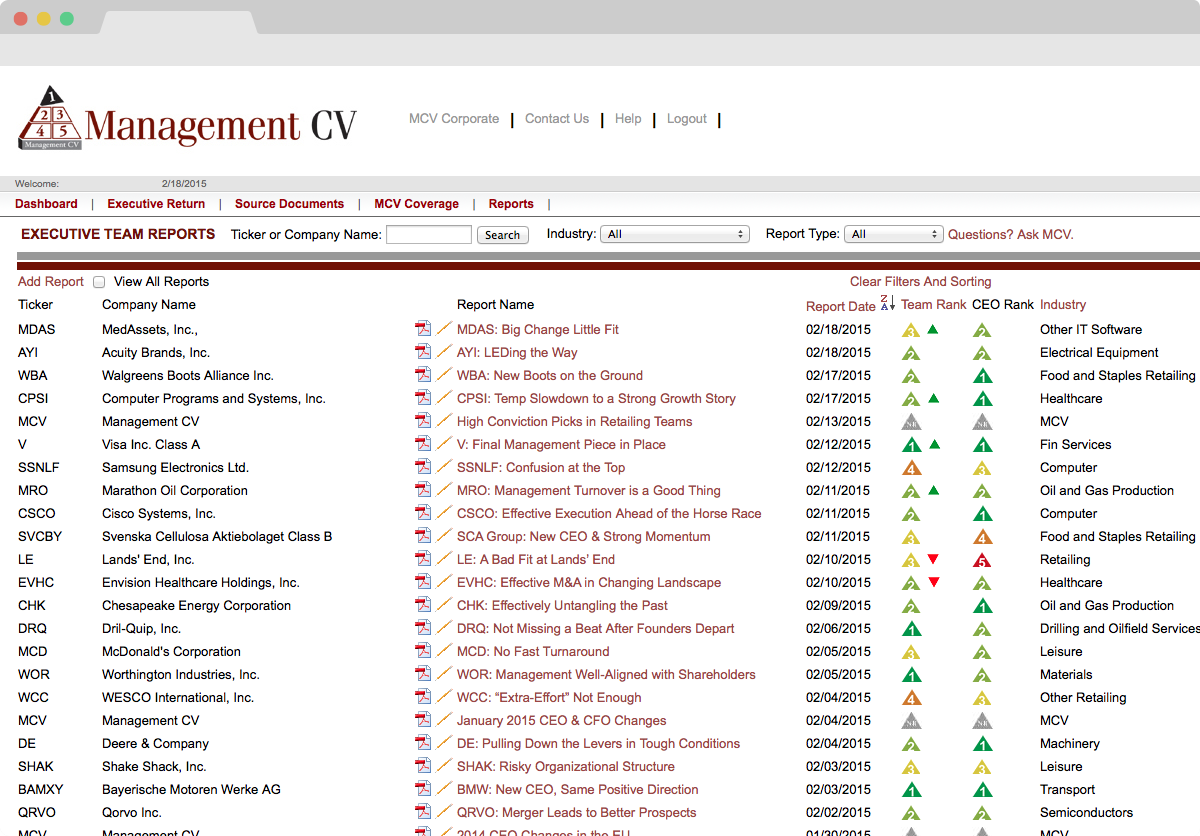

We serve the needs of professional money managers and other fiduciaries who need expert diligence and analysis on CEOs and senior executives that run public firms. We use a structured methodology to evaluate the relative quality and skill of managers, helping equity and debt investors to determine the relative risk and operating ability associated with those executives.

We work solely for our clients and have no brokerage, investment banking, or corporate finance conflicts.

Our services are provided on an annual retainer basis and our clients number among the largest and most successful professional investors in the world. Clients can utilize our expertise for special diligence projects, data analysis and comparative studies of senior managers across industry and geographic regions.

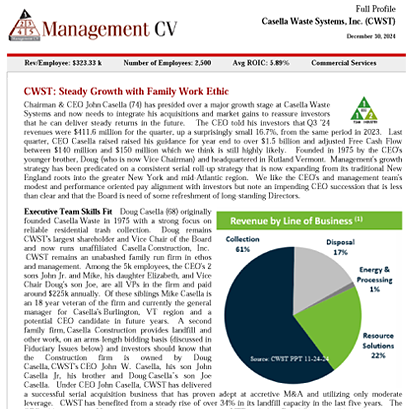

Our management profiles are renowned for their concise coverage of the key facts and figures investors need to know.

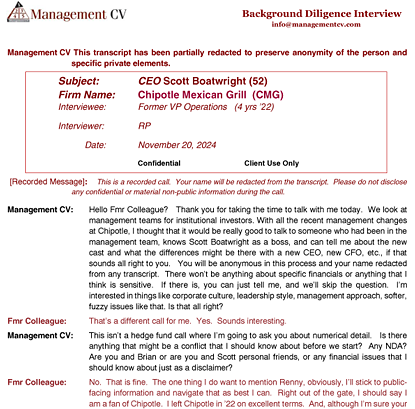

We provide verbatim interviews with former employees of senior executives. Names are redacted and our Client remains anonymous so that candor and insight are maximized and details are extensive. Call for details.

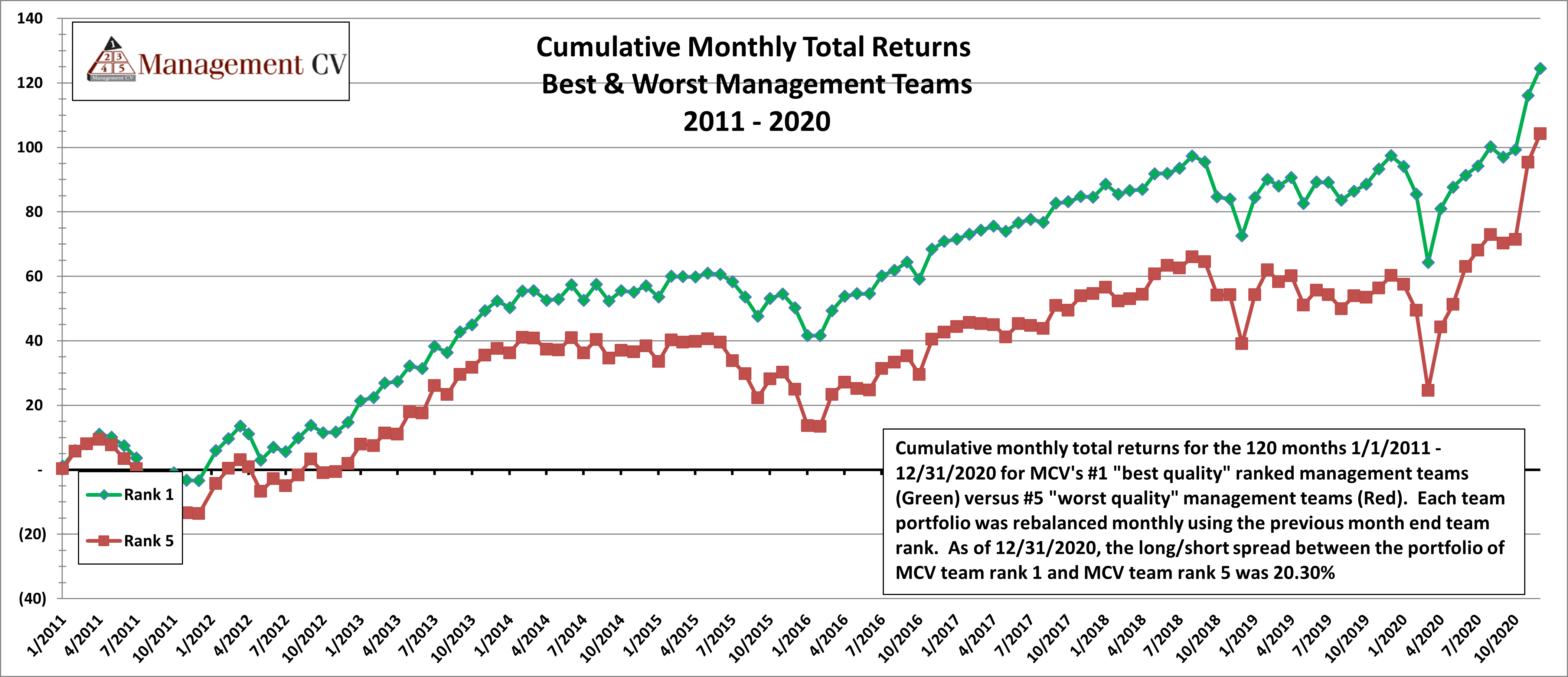

Management CV is a pioneer in applying statistical science to evaluating the skill and quality of management. Our methodology blends the historical facts of an executive’s track record with a qualitative assessment of forward-looking variables of interest to investors and lenders. Our Analysts work from structured due diligence templates to insure that they cover key issues of track records, compensation, and fiduciary risks consistently and reliably.

Fiduciaries in the investment, lending, and insurance markets can rely upon Management CV’s system to insure that they are properly, and factually, aware of the background and incentive alignments of the management teams in their portfolios. Our team lets you leverage your time efficiently and focus on what you need to know about facts that correlate to performance.

from CFO.com - January 10, 2020

Carolina Dybeck Happe's background makes her an unusual choice to run finance at the struggling conglomerate, a research report suggests.

from Reuters - May 8, 2019

Investor disappointment at Lyft Inc’s growth outlook underscores the pressure for rival Uber Technologies Inc to show potential backers of its initial public offering that it can expand services such as food delivery even as its core ride-hailing slows down.

from Fortune - April 25, 2019

Plenty of viewers binge on junk while watching Netflix. Now Netflix itself is binging: on junk bonds.

from Fortune - April 4, 2019

Depending who you ask, ex-Wells Fargo CEO Tim Sloan was either fair game to be fired—or unfairly faced a firing squad.

from MarketWatch - Jan 2, 2019

Critics are concerned that the Oracle co-founder’s friendship with Elon Musk and his large stake in Tesla may create a conflict of interest

from S&P Global - September 14, 2018

Summary - Appointment of Stephen Scherr as CFO most recent in Goldman management changes.

from Barrons - June 29, 2018

Summary - General Electric (GE)—and its investors—has been let down by its chief executives. Can John Flannery finally do right by the company, which was booted from the Dow Jones Industrial Average earlier this month?

from WSJ - June 12, 2018

Summary - Automatic Data Processing Inc.'s finance chief plans to resign from his post. Jan Siegmund will remain in the role while ADP looks for a replacement, Chief Executive Carlos Rodriguez said during a meeting with investors Tuesday.

from CFO.com - May 14, 2018

Summary - New Papa John’s International CFO Joe Smith had been with the company for 18 years when he was tapped last month to lead finance. So, he presumably knew what he was getting into. Yet he’s got an essentially “impossible” task in front of him, according to Management CV.

from WSJ - December 17, 2017

Summary - CSX Corp. hired the renowned railroad turnaround artist Hunter Harrison in March with much fanfare and investor support, despite concerns about his undisclosed illness. Now, that decision has backfired, leaving one of the biggest U.S. railways with a depleted leadership team in the midst of a restructuring.

or email us at

1101 30th Street, Suite 500

NW, Washington, DC 20007